DEVELOPED AN ANALYTICAL MODEL USING ARTIFICIAL INTELLIGENCE TO PREDICT THE RESULTS OF THE VALUE ADDED TAX A CASE STUDY OF THE REVENUE DEPARTMENT THAILAND

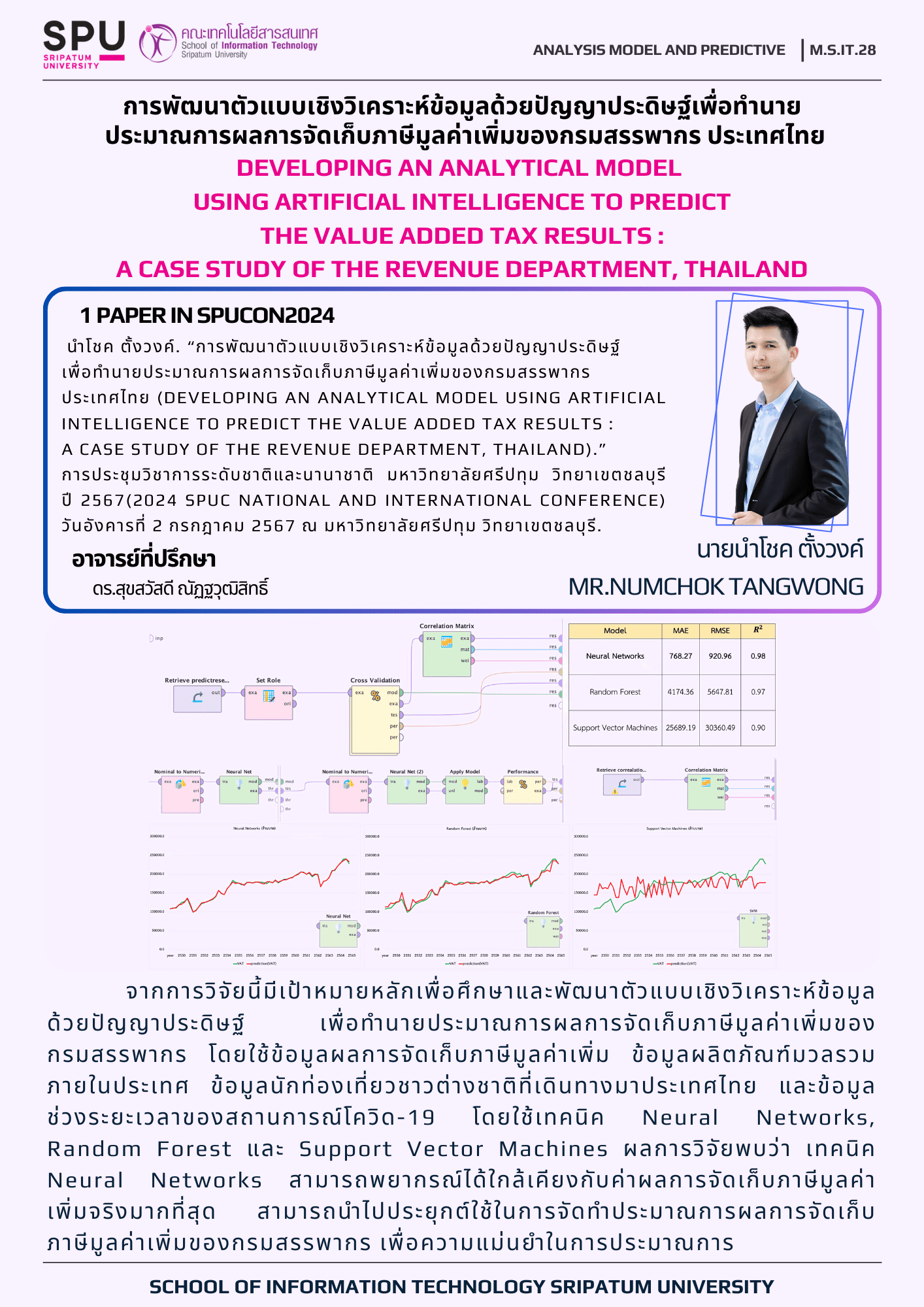

This research aims to study the factors related to the collection of VAT by the Revenue Department of Thailand, to develop an AI-based data analysis model to predict the estimated value-added tax collection of the Revenue Department of Thailand, and to test and evaluate the results of the forecasting of the estimated value-added tax collection of the Revenue Department using AI. The samples include the data of the VAT collection of the Revenue Department, the Gross Domestic Product (GDP), and the data of foreign tourists traveling to Thailand for 16 years, which are data from 2007 to 2022 and the period of the COVID-19 situation. The research tool is RapidMiner Studio using Neural Networks, Random Forest, and Support Vector Machines techniques to create a data analysis model for application in preparing the estimate of the value-added tax collection. The research results found that the Neural Networks technique can predict the value closest to the actual value-added tax collection. With the mean absolute error (MAE) of 768.27, the lowest root mean square error (RMSE) of 920.96 and the highest variance (R-squared: R²) of 0.98.